A Brief Analysis of Global Regulatory Intensity

To facilitate your understanding, we have divided the regulatory status of each country into the following five categories:

Unregulated and unplanned (NR): Cryptocurrencies operate freely in such countries, but the risks are higher, consumer trust is lower, and access to traditional financial services may also face challenges.

Unregulated but Planned (PI): While a clear regulatory framework has not yet been established, there is a clear intention to be aware of possible increased regulatory costs and obstacles in the future.

Weak regulation (W): There is a basic regulatory framework, but there are uncertainties and limited safeguards.

Rationally Regulated (R): Clear cryptocurrency regulatory guidelines and a balance between innovation and consumer protection provide a stable environment for cryptocurrency-related activities.

Strict and demanding regulation (D): The strict and complex regulatory rules in such countries may have a disincentive to innovation.

Please note: Cryptocurrency regulation is a constantly evolving field and the following information is only representative of the current situation. Be sure to consult the latest regulatory requirements before carrying out relevant activities.

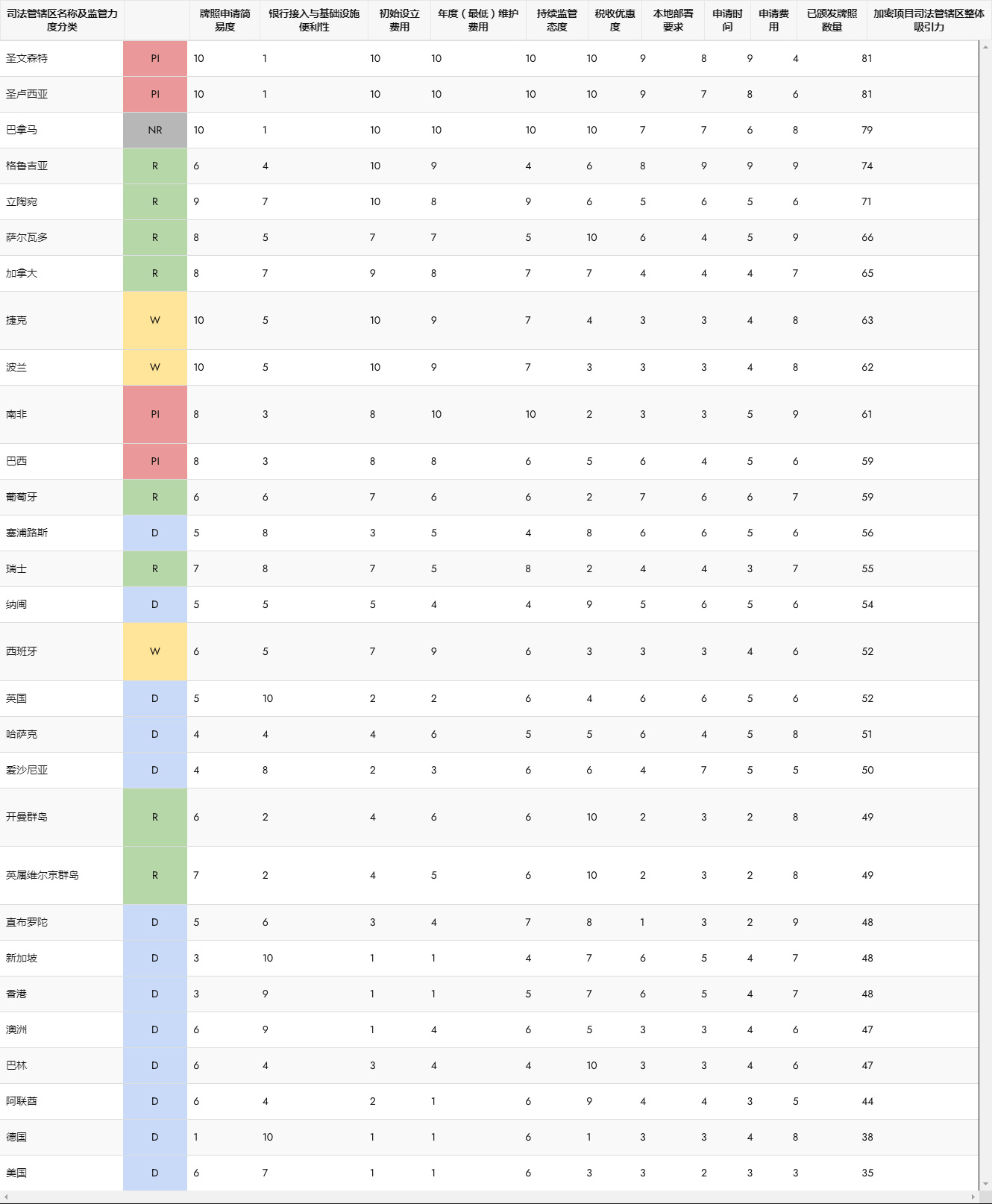

Our team delved into cryptocurrency jurisdictions around the world and selected 29 regions with potential. These regions were comprehensively scored by the following evaluation criteria:

Assessment Criteria and Rating Scales

We use a 10-point assessment framework (10 is the best) to assess the attractiveness of each jurisdiction. The evaluation criteria are considered from multiple perspectives, including:

Simplicity of licence applications:. Accessibility to obtain a cryptocurrency license, including time, capital and local deployment requirements, application fees, and document complexity.

Bank access and infrastructure convenience: the ease of establishing bank relationships and obtaining liquidity providers, the availability of cryptocurrency-friendly payment institutions, banking infrastructure and international banking channels.

Initial set-up costs: The upfront costs of setting up a cryptocurrency-related business in each jurisdiction.

Annual (minimum) maintenance expenses: Ongoing costs and minimum expenses required to maintain operations.

Continuous regulatory attitude: the regulatory approach and the frequency and complexity of reporting requirements of the regulator.

Tax benefits: Tax implications for cryptocurrency businesses and investors, including corporate tax rates, dividend taxes, and any incentives or deductions.

Local deployment requirements: Whether a cryptocurrency license requires a physical office and local staff.

Application time: The expected processing time of the cryptocurrency license application.

Application cost: The direct cost of the application process itself.

Number of licences issued: an indicator of market maturity and regulatory openness.

Jurisdictional Attractiveness at a Glance

Through detailed analysis, we provide you with a score of the regulatory environment for cryptocurrencies in each jurisdiction, so that you can quickly understand the attractiveness of each region and provide a reference for your cryptocurrency business layout.

Global Cryptocurrency Licence Overview FAQ

Other recommend Licenses

A Gateway to Global Digital Financial Innovation

In Dubai, exploring the dynamic world of virtual assets becomes even easier with VARA. As the world's first independent regulator focused on virtual assets, VARA sets a new standard for digital finance by providing clear regulatory guidelines, strong anti-money laundering measures and a sound legal framework. This streamlined process enables virtual asset service providers to operate safely and efficiently, helping your business achieve long-term success in one of the world's most dynamic financial centers.

Leading Cryptocurrency and Blockchain with Clear Regulation

In 2021, El Salvador took a disruptive step by becoming the first country in the world to incorporate Bitcoin into its legal tender system, ushering in a new era of regulation and application of cryptocurrencies. This groundbreaking decision has stimulated global enthusiasm for innovation and attracted the attention of countless investors and companies.

With the introduction of the Digital Asset Issuance Law (DAI Law), El Salvador has further established its friendly regulatory environment for cryptocurrency businesses. El Salvador offers two main cryptocurrency licenses: Bitcoin Service Provider...

MiCA(Markets in Crypto-Assets) is a new regulation introduced by the European Union to establish a unified regulatory framework for the crypto asset market in Europe. The bill is mainly aimed at the cryptocurrency and virtual asset markets. The goal is to regulate the behavior of market participants, protect the rights and interests of investors, combat market manipulation and money laundering, and promote the innovation and development of the crypto market while ensuring market security.

Customer Witness