How we can help you successfully join an SRO

Figure 1: Article 2 of the Swiss Anti-Money Laundering Act (AMLA)

Why Switzerland? Core advantages of joining an SRO

What can I do with an SRO membership?

Can Swiss SRO members operate in the EU?

Core Requirements for Applying for Swiss SRO Membership

How we can help you successfully join an SRO

External Compliance Team: We take overall responsibility for Swiss regulatory compliance, ensuring that your policies and processes meet FINMA and SRO requirements. With our experience, we can significantly increase your pass rate.

Strategic guidance: We will tailor a compliance plan for your crypto or fintech business, from choosing the type of company (GmbH or AG) to recommend the right SRO (e. g. VQF or SO-FIT).

One-stop support: We provide one-stop services covering the entire process, including company registration, legal advice, document review, AML/KYC policy development, and external audit coordination, which greatly simplifies the application process.

Enterprise accounts: With our expert guidance, you can more easily set up crypto-compatible banking and payment channels. We will introduce you to the right banking, electronic money institution (EMI) and card payment solutions.

Follow-up compliance support: Once you have an SRO membership, we don't stop there. We will continuously provide you with audits, reports and the latest regulatory developments to ensure a smooth and worry-free day-to-day operation.

Ready for your Swiss SRO? Let's join hands! Contact us immediately.

Geneva is one of the top 10 financial centres in the world, thanks to the Swiss Financial Market Supervisory Authority (FINMA). FINMA's core responsibilities include maintaining the stability of the financial system and ensuring the compliant operations of financial service providers. It authorizes and regulates banks, insurance companies, stock exchanges and other key market participants, including financial technology, banks, securities companies, DLT trading venues and fund management institutions.

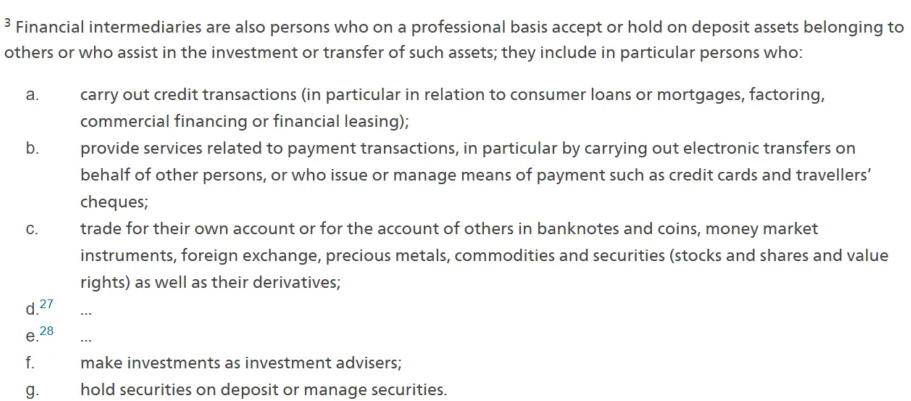

For other financial intermediaries that are not directly subject to FINMA's full supervision, Switzerland requires them to join self-regulatory organizations (SROs), such as VQF or SO-FIT, which are also authorized and supervised by FINMA. According to article 2 of the Swiss Anti-Money Laundering Act (AMLA) (see figure 1), anyone who professionally accepts, holds, invests or transfers the assets of another person is considered a financial intermediary. According to Article 1496 of Swiss law, these intermediaries must join the SRO to ensure that they meet Swiss anti-money laundering (AML) standards.

Figure 1: Article 2 of the Swiss Anti-Money Laundering Act (AMLA)

According to Article 1496 of Swiss law, these intermediaries must join a self-regulatory organization (SRO) to ensure that they meet Swiss anti-money laundering (AML) standards.

Why Switzerland? Core advantages of joining an SRO

A transparent legal system:

Relying on a rigorous and business-friendly legal environment, Switzerland provides clear regulatory guidelines and a high level of trust for companies and investors.

A sound financial infrastructure:

Switzerland is a global financial center with robust banks, payment gateways and other essential financial services.

3. Excellent corporate image:

By complying with Swiss regulatory standards, you can significantly increase your company's credibility in the eyes of customers and investors around the world.

Flexible tax system:

Enjoy the favorable tax system of Switzerland and the tax incentives that cantons (Canton) may provide to optimize the operating costs of enterprises.

5. High level of blockchain community:

The Swiss blockchain and crypto ecosystem is thriving, bringing together a number of innovators and experts to push the industry's frontiers.

6. Government support:

Switzerland is known for its forward-thinking legislation and support for emerging financial services, keeping your business at the forefront of technology and regulation.

What can I do with an SRO membership?

With a Swiss SRO membership, you will be subject to Swiss Anti-Money Laundering (AML) standards, but will not be directly regulated by FINMA, making you ideal for a diverse fintech and crypto business. The main business scope that can be carried out includes:

1. Legal Currency and Crypto Payment Services

Payment Processing and Settlement

Transfer of fiat or crypto assets *

Receiving or assisting in the transfer of third-party assets

Electronic Transfer

2. Crypto Asset Custody

Independent Custody Wallet (no upper limit)

Co-managed wallets (total limit of CHF 1 million)**

3. Encryption Services

ICO, STO or ISPO

Issuance of 1:1 fiat-backed stablecoins (bank guarantee required)

4. Card Issuance

Manage or issue payment instruments

Provision of payment services

Credit and debit cards

5. Accepting public deposits

Limit to 1 million CHF**

If the funds come from institutional investors with professional financial management, they are not subject to this restriction.

Other exceptions subject to specific provisions

6. Operate a fiat/cryptocurrency exchange (CEX / FX)

Recharge/Withdrawal of Legal Tones and Cryptocurrencies

Exchange between fiat currencies, between cryptocurrencies

Mutual exchange of fiat currency and cryptocurrency

7. Brokerage/Trading

Trading cryptocurrencies *

Trade fiat, precious metals, commodities (additional authorization may be required)

8. Crypto Asset Management

Managing Cryptocurrency * Assets

As a cryptocurrency * market maker

9. Credit and loan operations

Mortgage Loans

Finance Leasing

Commercial Loans

Consumer credit (additional authorization may be required)

* Note: "Cryptocurrency" generally covers digital tokens or currencies. The SRO may make further requests depending on the type of token.

*** Note: The amount of CHF 1 million can be adjusted according to specific arrangements or SRO regulations.

Can Swiss SRO members operate in the EU?

The concept of "reverse solicitation (reverse solicitation)" is crucial when financial intermediaries (including crypto businesses) with Swiss SRO membership wish to offer services to customers in the EU without an EU license.

In short, reverse solicitation means that a non-EU institution can provide a regulated financial service to an EU customer only if the customer has independently requested it and is solely based on its own needs. This principle is clearly reflected in MiCAR Article 61 and MiFID II Article 42, but it is difficult to form a universal guidance because it needs to be evaluated on a case-by-case basis.

ESMA's latest guidance on reverse solicitation

The European Securities and Markets Authority (ESMA) has released a detailed interpretation of the concept of reverse solicitation in the forthcoming Crypto-Asset Market Regulation (MiCAR). Although focused on the crypto-asset space, the guidance also addresses the broader regulation of reverse solicitation, including promotional campaigns, the use of non-EU platforms, and the role of third parties such as celebrities or sponsors.

Technology-neutral solicitation concepts: Face-to-face meetings, digital advertising, social media campaigns, etc. may trigger "solicitation".

Broad definition of marketing: Through regional SEO, advertising for the EU market, the use of EU domain names or sponsoring activities in the EU region, it may be regarded as active marketing to EU customers, so that reverse solicitation cannot be applied.

Educational materials and activities: ESMA recognizes the importance of content and industry activities that are purely educational in nature, but must prevent situations that disguise education but are actually marketing.

Trading venues and third parties: Non-EU platforms or third parties that assist in publicity may also affect the application of "reverse solicitation.

Promotion of new products or services: Reverse solicitation is limited to the same type of crypto asset or service that the customer originally requested. If the promotion of different types of products, customers need to take the initiative to put forward new requirements again.

In short, entities regulated by SROs in Switzerland can provide crypto-related services to EU customers through reverse solicitation, but should be extremely cautious to avoid being identified as active marketing within the EU, otherwise they may face severe penalties.

Core Requirements for Applying for Swiss SRO Membership

1. Company members (qualified and eligible)

All members are required to provide a valid passport and proof of address

Description of sources of funds

2. Document preparation

Business Plan

AML/KYC Policy

公司章程(Articles of Association)

Shareholding Structure

Branch or Affiliate Details

3. Local Entity Requirements

Appointment of Compliance Officer and Director/Signatory in Switzerland

Have a physical office address in Switzerland

4. Minimum capital

Limited liability company (GmbH / Sàrl): CHF 20000

AG (AG / SA): CHF 100000

How to choose the type of legal entity in Switzerland

Depending on your business goals, company size, and capital needs, you can choose from two common forms:

1. Limited liability company (Sàrl / GmbH)

Minimum capital: 20000 Swiss francs

Shareholders: at least 1 and at most 100

Shareholder anonymity: the list of shareholders is open to the public.

Transfer of shares: subject to approval by the general meeting of shareholders

Suitable for: small and medium enterprises, family business

Listing: unable to be listed on the stock exchange

2. Joint Stock Company (SA / AG)

Minimum capital: 100000 Swiss francs

Shareholders: at least 1 person from unlisted companies and at least 7 persons from listed companies

Shareholder anonymity: can be anonymous (for non-listed companies)

Share transfer: relatively more flexible

Suitable for: larger enterprises, companies planning global expansion

Listing: can be listed on the stock exchange

Before submitting an application

1. Document collection and preparation: collate and review all necessary documents and develop a business plan that meets Swiss AML/CFT requirements.

2. Enterprise architecture and establishment: to provide you with professional advice on the type of company (such as GmbH or AG). Assist in company registration and capital injection, and provide the company's legal address in Switzerland.

3. Team building and banking solutions: help recruit and train local AML officers and directors/signatories. Open an operating account with a financial institution compatible with the crypto business.

SRO Application and Authorization Phase

1. Compliance training and documentation: Provide training to local AML officers and directors on Swiss regulations. Summarize and compile all materials required for SRO application.

2. Communication and Q & A with regulators: Prepare to respond to questions that may be raised by SRO or FINMA and submit supplementary documents. Maintain continuous communication with regulatory authorities until successful SRO membership.

After approval

1. Document handover and final procedures: provide all relevant supporting letters, membership certificates and official membership numbers. Complete handover of necessary documents to ensure the smooth running of your day-to-day operations.

2. Continuous compliance and policy updates: Track regulatory changes and assist in updating AML/CFT/KYC policies. Handle regular audits, reporting and daily compliance management.

3. Follow-up bank and payment solution expansion: introduce more payment channels and solutions for you, including EMI and card institutions. Help develop new business or products within the scope of SRO compliance.

The whole process takes about 5-6 months.

Swiss SRO Membership FAQ

-

1. Why choose Switzerland for crypto or fintech business?

Switzerland has a good balance between strict regulation and corporate friendliness, a stable financial infrastructure and a world-recognized reputation. Not only does it enhance the credibility of your business, but it also connects you to crypto-friendly banks, a vibrant blockchain community, and government support for innovation. -

What is a Swiss Self-Regulatory Organization (SRO)?

SROs are private regulatory bodies authorized by and operating under the supervision of FINMA, whose primary function is to monitor members' anti-money laundering (AML) compliance. By joining an SRO such as VQF or SO-FIT, you must meet similar compliance standards to FINMA's direct supervision, but you do not need to obtain a full banking or FinTech license. -

3. Must all financial intermediaries in Switzerland be approved by FINMA?

Not so. Banks, securities dealers, DLT exchanges and other large institutions need to be directly regulated by FINMA. Smaller financial intermediaries, such as certain crypto platforms, payment services or custodians, simply join the SRO and comply with the requirements. Article 1496 of Swiss law clearly stipulates that the relevant intermediary must have SRO membership. -

4. Is SRO membership equivalent to a banking licence?

It's not equivalent. SRO membership is primarily evidence of compliance with Swiss AML/CFT requirements, but does not confer all the powers or obligations contained in a banking licence. For businesses that do not require direct FINMA regulation, an SRO is an ideal way to obtain legal compliance status. -

5. What types of businesses can I run under my SRO membership?

You can carry out a variety of financial services, including (but not limited to):

Legal Currency and Cryptocurrency Payment Services

Crypto Asset Custody

Operate a fiat/cryptocurrency exchange (CEX/FX)

Brokerage and trading (cryptocurrencies or parts of traditional assets)

Issuance of loans, finance leases or mortgages (with additional authorization requirements if required)

Stable currency issuance or other token issuance activities -

How long does the application process usually take?

It usually takes 4-5 months from the start of company registration to the final SRO membership, covering all aspects of business registration, document preparation, regulatory review and establishment of local entity and bank relations. -

7. Must I have a physical office and local staff in Switzerland?

Yes. According to the SRO, you are required to establish an office in Switzerland and appoint a local director/signatory and a compliance officer to ensure a timely response to local regulations. -

8. What is the minimum capital required to register a Swiss company?

Limited liability company (GmbH / Sàrl): CHF 20000

AG (AG / SA): CHF 100000 -

9. After obtaining an SRO membership, can I provide services directly in the EU?

Not so. Separate licences are generally required in the EU to provide regulated services to EU customers. However, non-EU companies may in some cases rely on the principle of "reverse solicitation", where EU customers initiate requests. This process is very dependent on the specific situation, once the violation will face severe penalties. -

10. What does "reverse solicitation (reverse solicitation)" mean and why is it important?

Reverse solicitation refers to the initiative of EU customers to non-EU enterprises to put forward service requirements. Businesses cannot rely on this principle if they are found to be active in the EU. The ESMA guidelines provide more details on the definition of "solicitation", such as targeted advertising, sponsorship and online marketing, which may constitute active solicitation. -

11. Do I need to speak German, French or Italian to apply?

In most cases, the SRO accepts information in English. However, some official instruments or communications with local authorities may require translation. We can assist you with all the necessary translation work. -

12. What ongoing compliance work do I need to do after obtaining SRO approval?

Usually includes:

Conduct regular AML/KYC audits

Improve the report and file retention

Annual audit (internal or external)

Timely update process according to the latest SRO policy and Swiss legislation -

13. How do I open a bank account in Switzerland if I am a crypto-related business?

While Swiss banks will remain strict with crypto, the overall attitude is becoming more friendly. We will screen suitable banks or electronic money institutions (EMI) for you and assist you in meeting their due diligence and AML/CFT compliance requirements. -

14. Under my SRO membership, can I issue stable coins, payment tokens, or conduct ICO/STO?

In principle, it is possible, but it must meet the requirements of SRO and relevant Swiss laws on anti-money laundering. Depending on the type of token, you may also need additional legal advice or additional documentation. -

What is the difference between GmbH(Sàrl) and AG(SA)?

GmbH / Sàrl: minimum capital 20000 CHF; shareholder list public; suitable for small and medium-sized enterprises.

AG / SA: minimum capital 100000 Swiss francs; can guarantee shareholder anonymity (for non-listed companies); suitable for large or international enterprises; can be listed on the stock exchange. -

16. Is it possible to issue equity tokens or equity tokens under SRO membership?

Switzerland allows the issuance of securities under the premise of meeting the country's corporate law and financial market regulations. But whether you need an SRO membership or a FINMA license depends on your specific business model. We can provide you with professional analysis on a case-by-case basis. -

Do I need a compliance officer with Swiss nationality?

No specific nationality is required, but the Compliance Officer and Director/Signatory must be based in Switzerland to ensure immediate response and effective management of regulatory compliance matters. We can help you recruit the right professionals locally for these positions.

Other recommend Licenses

Leading Cryptocurrency and Blockchain with Clear Regulation

In 2021, El Salvador took a disruptive step by becoming the first country in the world to incorporate Bitcoin into its legal tender system, ushering in a new era of regulation and application of cryptocurrencies. This groundbreaking decision has stimulated global enthusiasm for innovation and attracted the attention of countless investors and companies.

With the introduction of the Digital Asset Issuance Law (DAI Law), El Salvador has further established its friendly regulatory environment for cryptocurrency businesses. El Salvador offers two main cryptocurrency licenses: Bitcoin Service Provider...

The Preferred Land for Global Crypto and Fintech Success

Switzerland is a global leader in financial innovation, with industries directly overseen by the Swiss Financial Market Supervisory Authority (FINMA) including fintech (FinTech), banks, securities firms, distributed ledger technology (DLT) trading venues and fund managers. For other financial intermediaries that do not need to obtain a full FINMA license, Switzerland requires them to join self-regulatory organizations (SROs)-such as VQF or SO-FIT, and these SROs are also authorized and supervised by FINMA...

Registering as a money service business (MSB) in Canada gives your company access to a broad market and a stable regulatory environment, making it ideal for companies that offer money exchange, money transfer, virtual currency services, and more. With our support, you can easily handle MSB registration and compliance requirements in Canada.

Customer Witness