Easily get your Salvadoran cryptocurrency license with expert support

Advantages of the El Salvador Cryptocurrency License

Regulatory Framework for Cryptocurrency in El Salvador

What activities are allowed after obtaining a cryptocurrency license in El Salvador?

El Salvador Cryptocurrency License Application Process

Easily get your Salvadoran cryptocurrency license with expert support

Professional team, full escort: We are well versed in El Salvador's encrypted currency regulations, carefully prepare BSP or DASP license application for you, and manage the submission process throughout the process, so that you have no worries.

One-stop-shop for peace of mind: We offer comprehensive services, including legal advice, document preparation, AML/KYC policy making, and more, to make it easy for you to start a cryptocurrency business in El Salvador.

Ready to start your cryptocurrency business in El Salvador? Contact us to make it great!

Advantages of the El Salvador Cryptocurrency License

Industry leader: As the first country in Latin America to establish a regulatory framework for cryptocurrencies, El Salvador is your first place to explore the cryptocurrency market.

Regulatory clarity and compliance: In El Salvador, you can operate within a regulatory framework with clear guidelines to help you navigate the cryptocurrency space smoothly.

Tax benefits: El Salvador offers significant tax benefits for cryptocurrency-related activities, including exemptions from capital gains tax, corporate income tax and VAT (0% tax rate).

Easy banking: As a legal tender, Bitcoin has made it easier for cryptocurrency companies to access banking services in El Salvador, a rare advantage worldwide.

Cost-effective: The minimum equity capital is only $2000, and the license fee is close to the people, so you can get started easily.

Reputation and trust: As a regulated entity, your brand will be more credible and attract more customers and investors.

Asset appreciation: Your Salvadoran cryptocurrency license can increase the value of your business and potentially pave the way for regional opportunities in Central and South America, opening the door to new collaboration or financing opportunities.

Regulatory Framework for Cryptocurrency in El Salvador

El Salvador Adopts Two-Tier Cryptocurrency Regulatory Framework:

Bitcoin Service Provider (BSP) Licence: Businesses that focus on providing Bitcoin-specific services. According to the Bitcoin Law, the Central Reserve Bank of El Salvador (BCR) is responsible for regulating BSP licenses.

Digital Asset Service Provider (DASP) license: covers other cryptocurrency-related services other than Bitcoin. The National Digital Asset Commission (CNAD), established under the Digital Asset Issuance Act, is responsible for regulating DASP licenses.

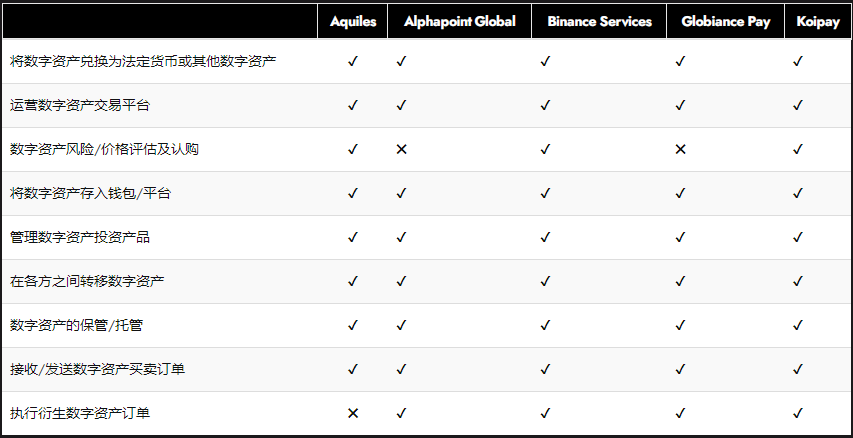

What activities are allowed after obtaining a cryptocurrency license in El Salvador?

Bitcoin-related services under the BSP license.

Bitcoin-related services: With a BSP license, you can provide a variety of Bitcoin services, including converting Bitcoin into fiat currency, processing Bitcoin payments, and holding Bitcoin securely for your customers.

Digital Asset Services under DASP Licence

Digital Asset Services: You can provide a variety of digital asset services, including cryptocurrency trading, sales of digital assets and derivatives, custodial solutions, and managing operations on behalf of third parties.

Stable Coin Issuance: You can develop and issue stable coins that are pegged to stable assets such as the US dollar, giving users a more stable option in the cryptocurrency world.

Cryptocurrency Trading: You can engage in cryptocurrency trading activities, such as buying, selling and exchanging cryptocurrencies, which are regulated by the DASP license.

Cryptocurrency Custody: Under a DASP license, you can provide cryptocurrency custody services for your customers to store cryptocurrencies securely.

Cryptocurrency Payment System: Create and manage a cryptocurrency payment system that facilitates the trading of cryptocurrencies.

Cryptocurrency Wallet Service: You can provide a cryptocurrency wallet service that enables users to securely store, send, and receive cryptocurrencies.

Cryptocurrency Trading Services: You can operate a cryptocurrency exchange and facilitate the buying and selling of cryptocurrencies.

Cryptocurrency Lending: If you are interested in cryptocurrency lending, the DASP license allows you to engage in these activities.

Cryptocurrency Investment Products: With a DASP license, you can create and offer a range of cryptocurrency investment products, including funds and ETFs.

Note: At present, 107 companies have been granted this license.

Note: At present, 14 companies have been granted this license.

Adhere to international best practice (FATF) standards;

Accounting records should be complete to ensure that all customer account data and transaction details are recorded in detail;

Adopt network security procedures;

Trading limits are to be matched with risk management and anti-financial crime policies.

Registered with CNAD;

Have Salvadoran legal representation;

Clear organizational structure;

Adopt network security procedures;

Have a risk management plan;

AML/KYC system;

Pay the registration fee and annual fee on time.

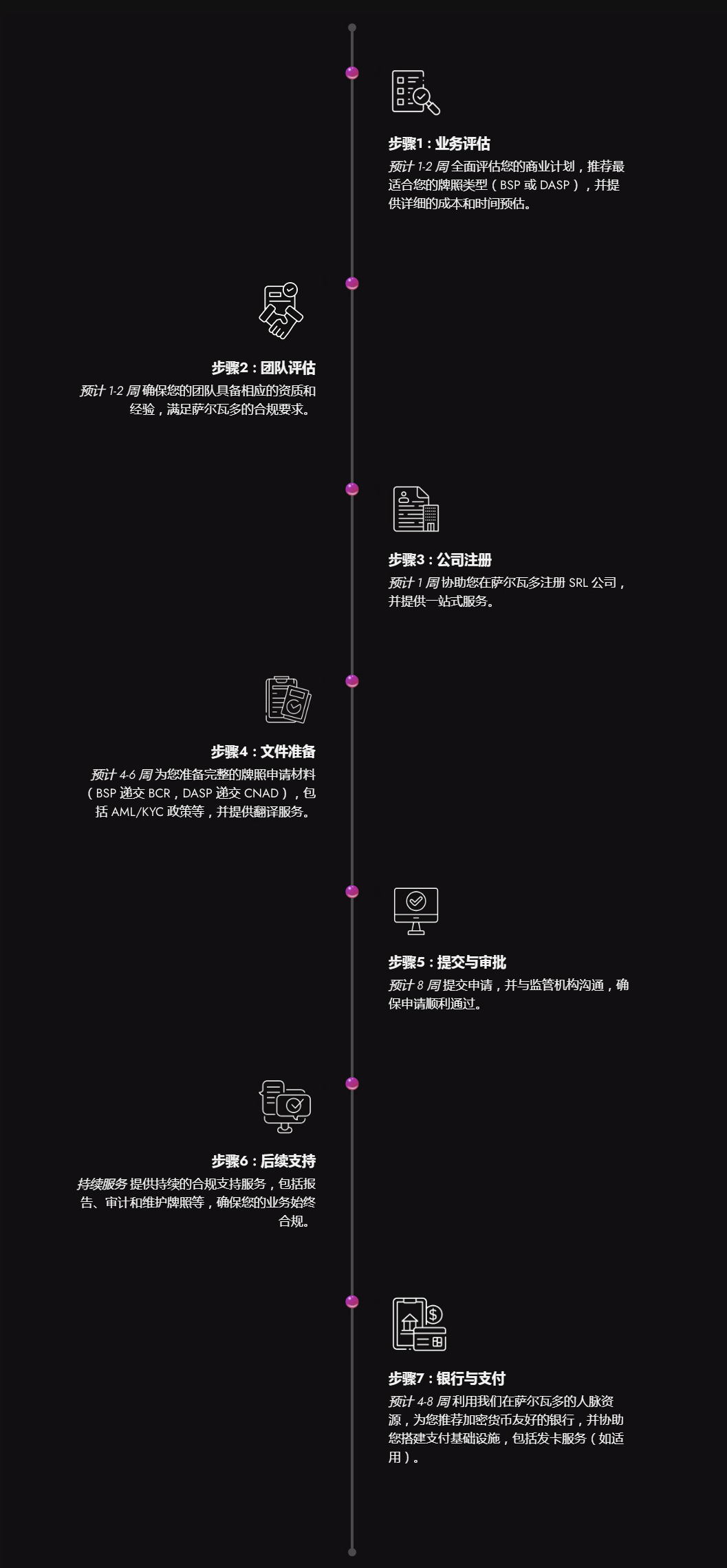

El Salvador Cryptocurrency License Application Process

Cost: Including application fees, company registration fees, anti-money laundering/KYC solution fees, professional service fees (such as translation), etc., please consult us for specific fees.

Time: The whole process usually takes 3-4 months. With our rich experience and extensive contacts, we ensure that you obtain a license in the shortest possible time.

Tax benefits for Salvadoran cryptocurrency companies

El Salvador offers an attractive tax policy for cryptocurrency companies, making it an ideal place for digital asset businesses. Companies registered in the Registry of Digital Asset Service Providers (RPSAD) can enjoy the following major tax benefits:

Corporate Income Tax Exemption: Cryptocurrency companies are exempt from corporate income tax, while other industries are subject to the standard 30% tax rate.

Tax exemption on digital asset gains: Capital gains and ordinary income earned in digital asset transactions, including sales or transfers, are tax-exempt.

Goods and services tax exemption: Transactions involving digital assets are not subject to goods and services transfer tax, and the income tax of issuers, certifying parties or service providers is also exempted.

Withholding Tax Exemption: RPSAD-registered companies are not required to make tax withholding on digital asset transactions.

These tax incentives have created a favorable environment for cryptocurrency businesses to grow, increasing the attractiveness of El Salvador as a hub for digital asset businesses.

El Salvador Cryptocurrency Licenses FAQ

-

Why did you choose El Salvador for your cryptocurrency business?

As the first country in the world to formally incorporate Bitcoin into the national legal tender system, El Salvador has a unique environment for the development of cryptocurrencies. It not only provides tax-free preferential policies for cryptocurrency companies, but also provides more convenient and flexible financial services, making El Salvador an ideal development place for cryptocurrency companies. -

Is cryptocurrency activity legal in El Salvador?

Yes, cryptocurrency activities are allowed in El Salvador, but a license is required. There are two types of licenses in El Salvador: one is specifically for Bitcoin and is issued by the Central Reserve Bank (BSP license); the other is fully authorized and administered by the National Commission for Digital Assets (DASP license). -

3. What is the difference between a BSP and a DASP license?

The BSP license focuses on Bitcoin-related services, while the DASP license is more extensive and covers a variety of other cryptocurrencies. We will provide advice and recommendations based on your specific business needs to help you choose the most suitable license type. -

4. What is the period for applying for a licence?

Under normal circumstances, it takes about 4 months to apply for one license, and it may take 6-7 months to apply for two licenses at the same time. However, the exact time may vary depending on the efficiency of the regulator and the need for additional materials. We will help you communicate with regulators throughout the process to ensure a smooth application process. -

Do I need a local team in El Salvador?

No need. El Salvador is flexible about where the core team is located, you only need to register your company locally and have an office address; there is no need for a local director, anti-money laundering reporting officer or physical office (recommended). You can leverage existing subsidiary resources or outsource some functions to streamline your operations. -

What does my team need?

El Salvador's experience in finance, compliance and IT is particularly valued. Depending on your situation, we can provide advice and support, including helping you connect with local talent, leverage existing expertise or recommend the right outsourcing partner. -

7. Can I operate in other countries after obtaining a El Salvador license?

El Salvador's license primarily allows for domestic operations, but there are no restrictions on the location of customers you can serve, which means you can look to the global market. When you enter a specific market, if you need a local license, we can also provide assistance and support. -

8. Is it difficult to find a bank that backs cryptocurrencies in El Salvador?

Compared to other countries, El Salvador is more likely to find banks that are open to cryptocurrencies. We will use our network resources to introduce you to the right banking partner. -

Are there any hidden fees during the application process?

In addition to official fees, legal support, company registration, ongoing compliance and possible translation costs are included. We provide a transparent list of fees to make sure you understand all the costs involved. -

10. What are the ongoing compliance requirements?

Once licensed, you will be required to submit regular AML/KYC reports and other relevant reports and be audited. We provide ongoing compliance support to ensure your business remains in line with local compliance requirements. -

11. Why choose your company?

We are experienced, customer-centric and use an efficient project management approach to handle licence applications. As a global regulatory expert, we are committed to being your long-term partner in global expansion. -

12. Can you help me with the license application?

Of course! From company registration to application preparation, submission, and communication with regulatory agencies, we will escort you throughout the process.

Other recommend Licenses

A Gateway to Global Digital Financial Innovation

In Dubai, exploring the dynamic world of virtual assets becomes even easier with VARA. As the world's first independent regulator focused on virtual assets, VARA sets a new standard for digital finance by providing clear regulatory guidelines, strong anti-money laundering measures and a sound legal framework. This streamlined process enables virtual asset service providers to operate safely and efficiently, helping your business achieve long-term success in one of the world's most dynamic financial centers.

With the rapid development of the cryptocurrency market, the regulatory strategies of various countries on cryptocurrencies are also changing with each passing day. To help businesses and investors better understand the global cryptocurrency regulatory landscape, we provide you with the following comprehensive and in-depth overview and analysis. The following table visually shows the current regulatory status of cryptocurrencies in countries around the world, giving you a clear understanding of the regulatory strength of each country at a glance.

The Preferred Land for Global Crypto and Fintech Success

Switzerland is a global leader in financial innovation, with industries directly overseen by the Swiss Financial Market Supervisory Authority (FINMA) including fintech (FinTech), banks, securities firms, distributed ledger technology (DLT) trading venues and fund managers. For other financial intermediaries that do not need to obtain a full FINMA license, Switzerland requires them to join self-regulatory organizations (SROs)-such as VQF or SO-FIT, and these SROs are also authorized and supervised by FINMA...

Customer Witness