FDUSD decoupling leads to regulatory doubts? VARA helps you move forward without worry!

Hong Kong Dilemma: Regulation is not yet mature

This incident has forced us to face up to a reality: although Hong Kong, China is an international financial center, its regulation of cryptocurrency business is still in the development stage. The Hong Kong Securities and Futures Commission (SFC) is currently focused on regulating virtual asset trading platforms involving securities attributes, but trust companies like First Digital Trust(FDT), which focus on stable currency issuance and asset custody, do not fully fall within the scope of SFC's regulation.

While the Hong Kong Monetary Authority (HKMA) is gearing up to develop a regulatory framework for stablecoin issuers, these new rules have not yet been implemented. At this stage, FDT's compliance relies more on its compliance obligations as a trust and corporate service provider (TCSP) than on strong regulation built specifically for digital assets.

This can't help but worry-whether the regulatory gap will become a hotbed for the next crisis?

U.S. Broken: SEC New Rules First

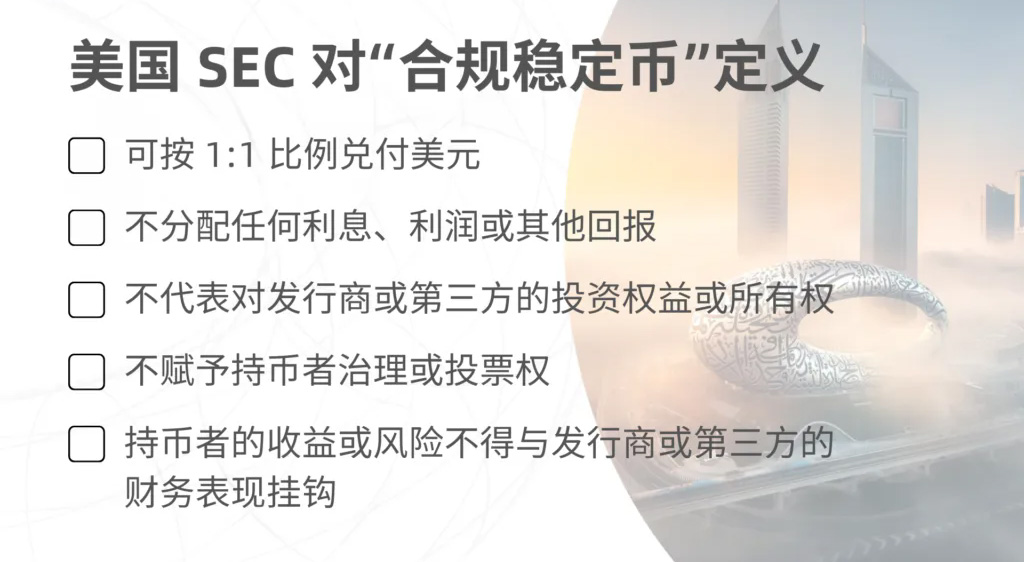

Looking at the United States, the global financial hegemon, its regulatory system for stable currencies has only just begun. Just on April 4, the U.S. Securities and Exchange Commission (SEC) issued the latest guidance, clear "qualified stable currency" can be exempted from securities reporting obligations, this statement undoubtedly for the industry to draw a watershed.

What is a "qualified stable currency"? The SEC has given a clear yardstick of judgment, and the key lies in its marketing positioning. Such stablecoins must be positioned as a utility for payment, money transfer or value storage, not as an investment target.

U.S. Broken: SEC New Rules First

At the reserve asset level, the SEC's requirements are more stringent. Eligible stablecoins need to be backed by highly liquid, low-risk assets such as physical U.S. dollars or short-term U.S. Treasury bonds, and also meet the following conditions:

Reserve assets are completely segregated from the issuer's working capital;

shall not be used for lending, pledging, re-pledging or any investment operation;

Not to be diverted from the Company's operating or business expenses;

Designed to be free from interference with third-party claims;

Although the interest income generated by reserve assets is allowed to be retained, it may not be distributed to holders of currency.

To further enhance transparency, the SEC also encourages issuers to regularly issue "Proof of Reserves" as a public verification mechanism for capital enrichment.

However, this guide does not take the whole picture. While the SEC unbundled qualified stablecoins, it left no word on algorithmic stablecoins such as Terra and Frax, as well as stablecoin products designed to provide revenue. The legal position of these "alternative players" is still up in the air, and once they are found to have securities attributes, compliance risks will follow. At a time when the boundaries of regulation are becoming clear, the next chess game in the stable currency market is clearly hiding more unknowns.

Dubai first: VARA leads the future

While global regulation is still fumbling in the chaos, Dubai has taken the lead. In early 2022, the Virtual Asset Regulatory Authority (VARA) became the world's first independent regulator focused on virtual assets. VARA's goal is ambitious and clear: to build Dubai as an international hub for digital assets, to enhance its digital financial competitiveness, and to nurture a sound ecology through efficient regulation.

VARA not only provides a clear compliance path for VASP, but also finds a balance between innovation and security. This initiative not only demonstrates Dubai's forward-looking vision, but also sets a benchmark for the encryption industry.

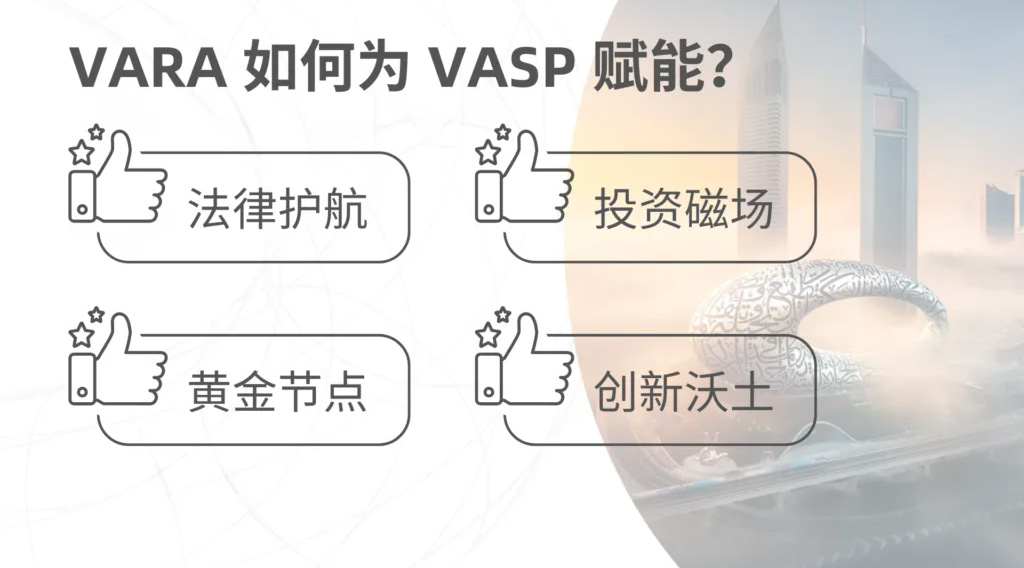

How does VARA empower VASP?

Legal Escort: Provide a transparent framework that adheres to anti-money laundering (AML) and cyber security standards to build a foundation of trust for businesses.

Investment Field: The VARA license symbolizes the compliance benchmark, attracting the attention of local and global capital, and injecting strong momentum into your business.

Geographical advantage: Dubai is the golden hub between Asia and Europe, putting your business at the node of global finance with business opportunities at your fingertips.

A fertile ground for innovation: The UAE embraces foreign investment and innovation with forward-looking policies to help you expand your crypto business landscape.

Rengang Yongsheng: Your Exclusive VARA Guide

Want to take the lead in digital assets in Dubai? Rengang Yongsheng is your best choice!

Professional insight: We understand the essence of VARA, from the core requirements to the rules of compliance, the whole process for your tailor-made guidance.

One-stop support: From business plans to anti-money laundering policies to financial and risk frameworks, we help you win your license.

Continuous help: Once licensed, we provide compliance updates, audit support and bank referrals to ensure you stay ahead of the curve.

The TUSD storm is a wake-up call, and the risks of regulatory gaps are everywhere. And Dubai's VARA, for you to pave a compliance and success of the smooth road. Contact Rengang Yongsheng now to open a new chapter in your digital finance!