One article to clarify the onshore license plate, offshore license plate! What exactly are the "trump cards" of encryption business "?

Onshore license plate vs offshore license plate, which is right for you?

No matter where you want to join the encryption business in the world, you need an onshore or offshore license, and this license will be the most critical step in your journey! Onshore licences (Onshore License) refer to financial or cryptocurrency operations licenses issued in major economies or established jurisdictions, such as the United States, the European Union, Switzerland, El Salvador, etc., while offshore licences (Offshore License) refer to licenses issued in offshore financial centers, such as the Seychelles, the Cayman Islands, etc. Simply put, the onshore license is an "authoritative pass" and the offshore license is a "flexible shortcut".

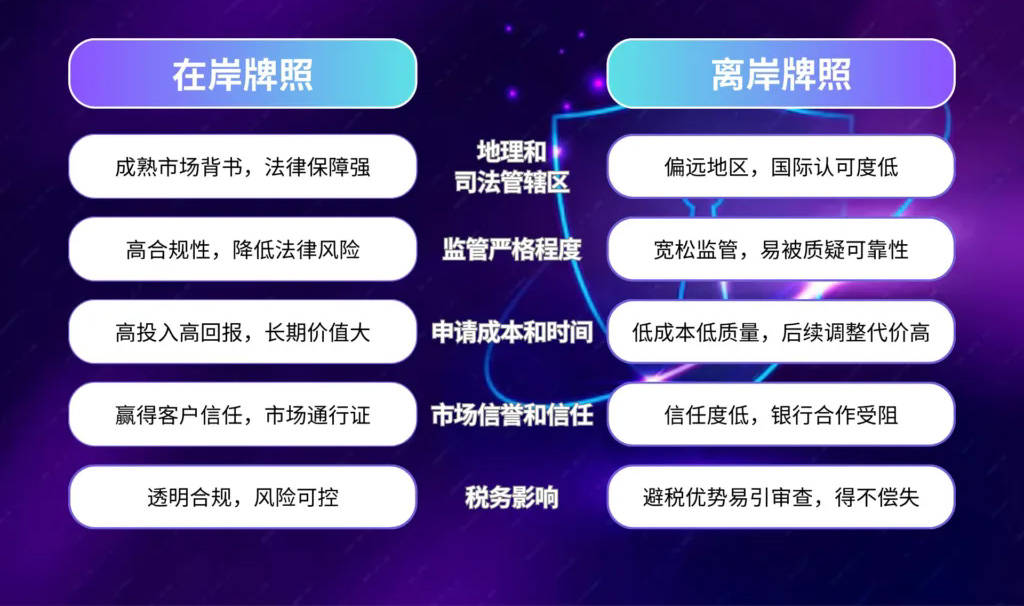

Next, let's quickly compare the differences from several dimensions:

Geography and Jurisdictions

Onshore licences are issued by global economic powerhouse and established jurisdictions, directly connecting the world's core markets. These regions are backed by strong legal systems and international reach, creating a rock-solid foundation for your business. Imagine Dubai's VARA license or the EU's MiCA framework-not only a symbol of compliance, but also a golden key to a global financial center.

On the other hand, offshore licenses are mostly from small offshore financial centers, with remote locations and minimal "presence" on the international stage. The regulatory framework in these regions is often tailored to attract foreign investment, but the legal status is difficult to recognize in the mainstream market, like a gorgeous but fragile business card, limiting the company's global ambitions.

Regulatory strictness

Onshore licenses are backed by strict regulations, including anti-money laundering (AML), know-your-customer (KYC) and anti-terrorist financing (CFT) regulations, and the compliance burden is heavy, but it forges high transparency and impeccable legitimacy in the business. Take the U.S. SEC or Swiss FINMA as an example, their stringent requirements push enterprises to establish a drip-tight wind control system, away from the legal minefield, for long-term steady development escort.

Offshore licenses are known as "low thresholds", and compliance measures are often in vain, even lacking substantive supervision. This illusion of "easy access" hides risks-companies are easily labeled as "unreliable" or "high-risk. Especially in the wave of global regulatory tightening, such as FATF travel rules, offshore licenses can become a ticking time bomb, detonating a compliance crisis at any time.

Application cost and time

It does cost tens of thousands to hundreds of thousands of dollars to apply for an onshore license, and it takes months to a year. Although the application cost is high and the approval time is long, it is definitely an investment worth betting on. This high investment is in exchange for high-quality regulatory endorsement and market access qualifications. One investment, in exchange for a steady stream of returns, especially in attracting large customers and financing, the advantages are unmatched.

Offshore licenses are tempting at a cost as low as a few thousand to tens of thousands of dollars, and quick approval in weeks to months, but this "cheap" has a hidden price. The effectiveness of the license is weak, like a chicken rib, enterprises are often forced to "make up a missed lesson" in the later period because they are unable to base themselves on the mainstream market and re-apply for an onshore license, resulting in a double waste of time and money, making the initial savings an expensive lesson.

Market reputation and customer trust

Due to strict supervision and authoritative sources, onshore licenses are like "golden signs" in the market, which greatly enhances the trust of customers and partners. For example, VASPs, which hold New York State BitLicense, not only easily win the favor of institutional investors, but also work seamlessly with banks to become a dazzling star in the industry.

Offshore licenses are often regarded as "second-rate players" due to loose supervision and regional reputation shortcomings ". Customers have doubts about its legitimacy, and banks may even close the door on cooperation. For example, when companies with Seychelles licenses try to enter the US market, they are often regarded as high-risk "intruders" and their trust is greatly reduced.

Tax implications

Onshore licenses are subject to local tax rates, which are heavily taxed, but in exchange for strong compliance safeguards to avoid the dark arrows of international tax audits. Transparent tax policies, companies can also make good use of RPSAD tax incentives such as El Salvador, legally optimize costs, and keep the future in their hands with the predictability of long-term operations.

The low tax rate or even zero tax on offshore licenses may seem attractive, but it is easy to trigger tax reviews in major economies such as CRS and FATCA, and even be included in the blacklist of "tax havens. Additional compliance costs and blocked cooperation have turned this "sweetness" into bitter fruit.

Applicable Scenarios

Onshore licenses are a sharp weapon tailored for companies that are deep in specific countries, target institutional clients, or pursue long-term development. For example, companies that want to launch encrypted trading services in El Salvador, the "land of Canadian currency", can hit the local market directly with DASP or BSP licenses, deeply integrate with the traditional financial system, and seize the commanding heights of competition.

Offshore licences are only suitable for start-ups or short-term projects, especially those that do not require local entities and serve retail investors. However, with the expansion of scale, its shortcomings have been exposed. Due to the inability to meet the regulatory needs of the mainstream market, companies are forced to adjust their structure, which only increases uncertainty. It is like building high-rise buildings on the beach, and the foundation is difficult to stabilize.

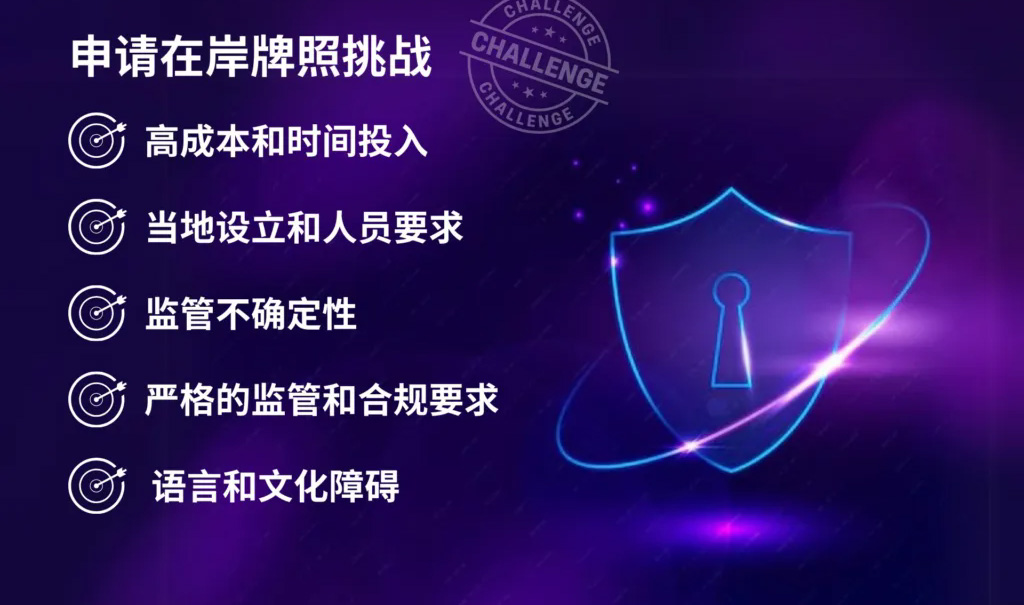

There are many advantages of onshore licenses, but the challenge is big?

The advantages of onshore licenses are their authority, stability and market competitiveness, which are the basis for building a sustainable cryptocurrency business, while the disadvantages of offshore licenses are reflected in low trust, high risk and future uncertainty, and short-term convenience is difficult to make up for long-term shortcomings. If your goal is to look at the world and grow steadily, the onshore license is undoubtedly the "trump card" worth betting on ".

However, the road to obtaining an onshore license for a cryptocurrency business is not an easy one, it is more like a marathon that requires patience and strategy. Taking El Salvador's BSP and DASP licences as an example, VASPs will face the following challenges:

High cost and time investment: the application process is like a "money-burning game", with legal advice, compliance settings, and application fees one after another, often tens of thousands or even hundreds of thousands of dollars. The approval process is often based on "months" or even "years", and months of waiting may get your business plan stuck on the starting line. The dual pressures of money and time test your patience and budget.

Strict regulatory and compliance requirements: AML, KYC, cyber security standards, etc., these are not simple "tick games", but need to be carefully built compliance procedures. El Salvador requires external cybersecurity audits and quarterly reports, reminding you at every step that compliance is no small matter. If there is a slight omission, all previous efforts may be wasted.

Local establishment and personnel requirements: Want to get a license? First set up a "home" in El Salvador-set up a local company, complete legal and administrative procedures, and have a resident compliance officer and deputy officer. For foreign players, this is not only a technical job, but also a resource job. From recruitment to training, the cost and effort is prohibitive.

Language and cultural barriers: To apply for an onshore license in El Salvador, all documents and communications must be in Spanish, which is like groping through the fog for VASPSs in non-Spanish-speaking countries. Poor communication, plummeting efficiency, and perhaps even missing key details. This requires a translation team or a local partner to not be "stuck".

Regulatory uncertainty: the regulatory framework of virtual currency is still in its adolescence, and the opacity of the process and the ambiguity of the policy make you walk on thin ice in implementation and understanding. If you step wrong, you may face additional adjustments or even start all over again.

Easy application for onshore license, Crytolicence for you!

Onshore licenses are an "authority pass", but these challenges are enough to give any VASPs a headache. That's why you need an experienced financial license expert to serve you-they're not just guides, they're game breakers. From sorting out processes and optimizing costs, to building compliance systems and crossing language barriers, they can help you avoid detours and hit your target straight. After all, every step in the journey of globalization is worth careful calculation.

How can we escort you?

Process guidance: Cryptolicence team of experts are well versed in local laws and regulations, which can help navigate the complex application process, reduce errors, and clearly sort out the timeline of the entire process for you to help you control the direction of business development.

Document preparation: Cryptolicence can draft and revise all compliance documents for you, such as AML, KYC policy formulation, etc., to ensure accurate compliance with regulatory requirements and help you pass the customs smoothly.

Local support: Cryptolicence rely on a strong local cooperation network to help you set up a local company, recruit compliance officers, and handle bank account opening and other matters, so that you can solve all problems in one stop, so that landing is no longer a challenge.

Language and cultural support: Cryptolicence remove language barriers for you, solve the translation of Spanish documents, provide localization support, and make every communication efficient and unimpeded.

Risk management: Cryptolicence professional compliance team from mainland China, Hong Kong, Singapore, Malaysia and other places, with rich international financial knowledge and compliance training, successfully completed more than 70 license applications around the world, greatly reducing the risk that you may be delayed or rejected due to misunderstanding of supervision.